Generix anuncia a nomeação de Laurent De Kimpe para o cargo de Diretor Financeiro

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix renova a sua Certificação ISO 27001. Saiba mais

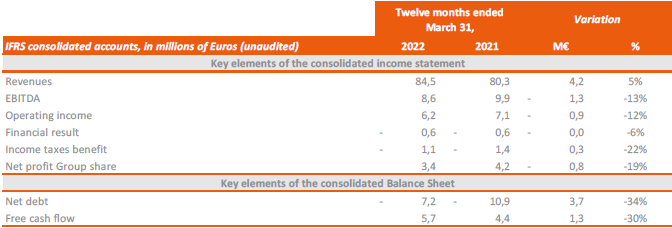

Revenues for the 2021/2022 financial year were up by 5%, with good momentum in the Software business – particularly at the end of the financial year – offsetting the slowdown in activity in North America, which weighed on the Consulting & Services business. Fiscal year 2021/2022 was also marked by the dynamic performance of SaaS signatures, which grew by 17% compared with the previous fiscal year.

At the end of March 2022, EBITDA was €8.6 million and the EBITDA margin rate was 10.2% (respectively €9.9 million and 12.3% at the end of March 2021). The strategic choice to maintain the R&D effort – as previously announced – has continued during the year, with the level of R&D expenses reaching 17% of revenues (17.9% in the previous year). Profitability for the year also includes the impact of the commercial slowdown in North America, where the Group has chosen to maintain its commercial structure in view of the expected rebound in activity.

As a result of these elements, the Group’s operating profit amounted to €6.2 million, compared with €7.1 million for the previous year. After taking into account financial income and taxes, which were relatively stable compared to the previous year, the Group’s share of net income was €3.4 million.

For the 2021/2022 financial year, cash flows are mainly marked by:

Fiscal year 2022/2023 will be subject to contrasting factors:

In the end, the Group anticipates stronger growth than in 2021/2022 and stable EBITDA.

Aceder ao documento

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix anuncia a disponibilização de schematrons para faturação eletrónica, desenvolvidos pelas suas equipas de Investigação e Desenvolvimento (I&D), com o…

A Generix Group, editor de soluções colaborativas SaaS para o ecossistema da Supply Chain, Indústria e Retalho, renova a Certificação…

Trabalhe com a nossa equipa para criar a sua pilha de software da cadeia de abastecimento ideal e adaptá-la às suas necessidades empresariais específicas.