Generix anuncia a nomeação de Laurent De Kimpe para o cargo de Diretor Financeiro

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix renova a sua Certificação ISO 27001. Saiba mais

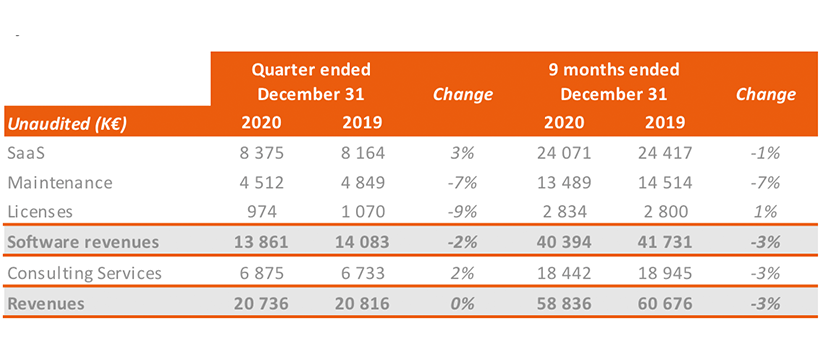

During this quarter, at the heart of the second wave of Covid-19 and the associated government restrictions (lockdown, curfew), Generix Group’s activity amounted to €20.7 million, almost stable compared to the same period last year and up 8.1% compared to Q2 2020/2021. Quarter after quarter, Generix Group illustrates the resilience of its model and confirms the trajectory of a return to normative growth levels. At constant exchange rates, quarterly revenues amounted to €21.3 million, up 2.4% compared with the same quarter last year.

This quarter also marks the return to revenue growth in SaaS activities, which grew by +3% at current exchange rates, thanks to a significant improvement in overconsumption compared with previous quarters.

Over 9 months, Group revenues were €58.8 million (-3%) at current exchange rates, and €60 million, a slight decrease of 1% at constant exchange rates.

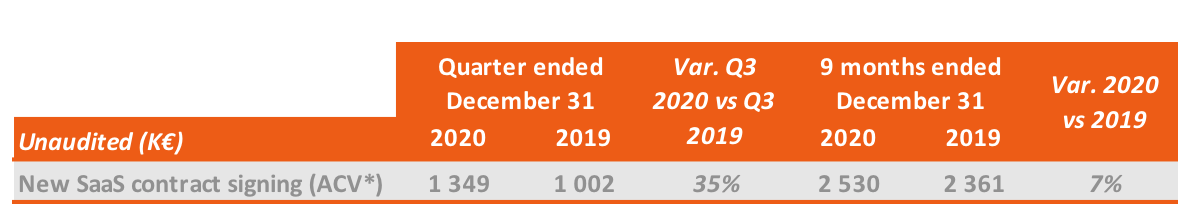

In addition to the resumption of growth in the SaaS business, the past quarter was also marked by a return to a sustained pace of new SaaS contract signatures, with strong growth of 35% over the quarter. This commercial dynamic has largely offset the temporary drop in signatures in the first half year: overall, SaaS signatures are up 7% over 9 months.

Among these new signatures, it should be noted:

A migration contract for a major player in specialized retail, which has chosen to switch the management of its warehouses and transport from a perpetual license model (On Premise) to a SaaS model;

A contract with a new customer on the Iberian Peninsula, a banking player that has chosen the Generix Supply Chain Hub platform to manage its exchange flows and the dematerialization of its invoices.

These contracts confirm Generix Group’s ability to respond to strategic customer needs and win the trust of major players.

Generix Group anticipates a sustained pace of new SaaS contract signings over the coming quarters, which should enable a return to normative growth as of the 2021/2022 financial year, after a slight decline in the 2020/2021 financial year.

Profitability trends for the 2020/2021 financial year should be in line with those observed in the first half year, with a controlled decline in EBITDA margin excluding the impact of the research and development effort.

With a sound and solid financial structure, a resilient business model, and a robust customer portfolio, the Group is confident for the future. As announced, it intends to continue its strategic investments in R&D to benefit from the potential of the supply chain and digitalization markets in which it already operates successfully.

Supplemental non-IFRS information (above-mentioned as EBITDA) presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies.

Next financial press release: April 28, 2021 after the market closes

Aceder ao documento

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix anuncia a disponibilização de schematrons para faturação eletrónica, desenvolvidos pelas suas equipas de Investigação e Desenvolvimento (I&D), com o…

A Generix Group, editor de soluções colaborativas SaaS para o ecossistema da Supply Chain, Indústria e Retalho, renova a Certificação…

Trabalhe com a nossa equipa para criar a sua pilha de software da cadeia de abastecimento ideal e adaptá-la às suas necessidades empresariais específicas.