Ageneau Group Chooses Generix WMS to Boost Growth

Puteaux, France, January 21, 2025 – Generix, a global business software company offering an expansive portfolio of SaaS solutions for…

Bona: Building Operational Excellence with Solochain WMS Read the use case

Discover practical guides, eBooks, podcasts, and much more. All designed to help you optimize and manage your supply chain.

Puteaux, France, January 21, 2025 – Generix, a global business software company offering an expansive portfolio of SaaS solutions for…

Subscribe to our newsletter

Puteaux, France, January 21, 2025 – Generix, a global business software company offering an expansive portfolio of SaaS solutions for…

Paris, France, 26 November 2025 – Generix, a global business software company offering an expansive portfolio of SaaS solutions for…

Paris, France, 24 November, 2025 – Generix, a global business software company offering an expansive portfolio of SaaS solutions for…

If you’re navigating supply chain complexity, facing pressure to modernize, or simply looking for a smarter way to manage your…

To optimize inventory management, retailers and suppliers are increasingly turning to Vendor Managed Inventory (VMI) tools that transfer the responsibility…

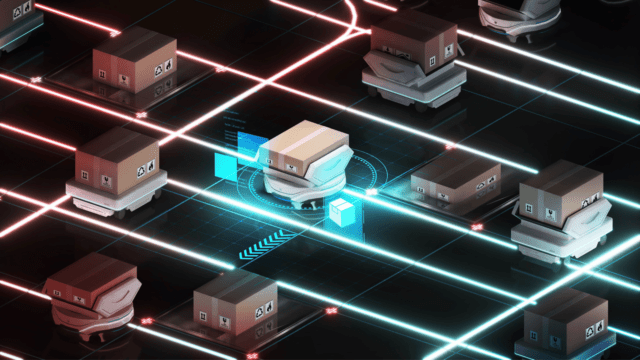

In an ever-evolving logistics environment, agile and precise warehouse resource management is essential to remain competitive. With increasing volumes driven…

Generix and Applium today announce their partnership formed to provide global Approved Platforms (AP) e-invoicing services to SAP customers.

The Generix 6th annual “Tax Reform & Electronic Invoicing Barometer” shows strong momentum, broad readiness, and tangible long-term benefits of…

How will companies evolve their supply chain management in order to survive in some cases and thrive in others?

Discover how your WMS can become the cornerstone of your logistics performance. 9 keys to choosing the system best suited…