How Vendor Managed Inventory (VMI) Strengthens Supply Chain Resilience and Collaboration

To optimize inventory management, retailers and suppliers are increasingly turning to Vendor Managed Inventory (VMI) tools that transfer the responsibility…

Bona: Building Operational Excellence with Solochain WMS Read the use case

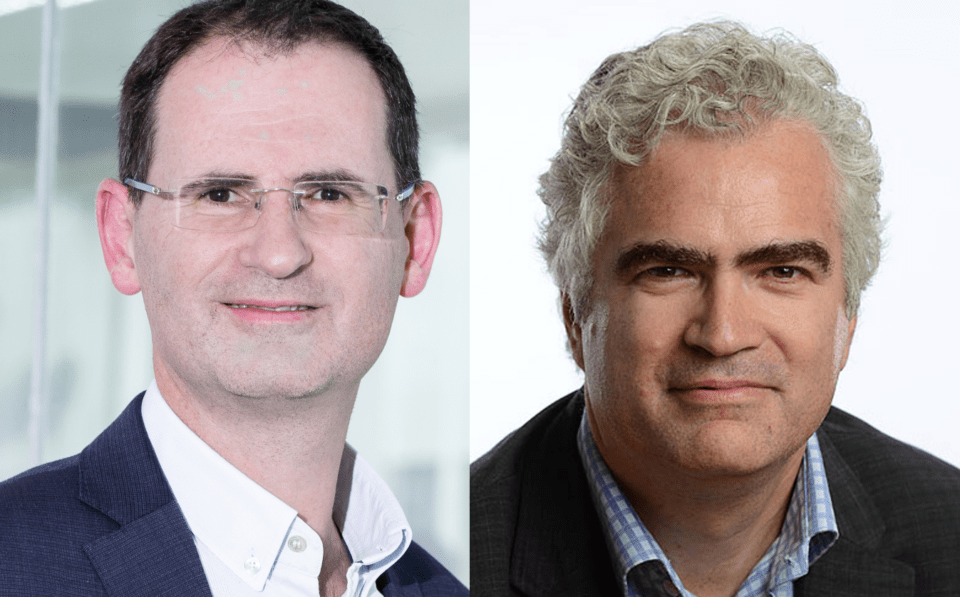

During the period between 2023 and 2025, the electronic invoices will gradually become compulsory for all French companies. Cyrille Sautereau, President of FNFE-MPE (the French National Forum for Electronic Invoicing and Electronic Public Procurement) answers our questions on the implications of this total dematerialization of B2B invoices. Christophe Viry, a Product Marketing Manager, identifies the key issues and explains the strategic guidelines proposed by the GENERIX Group to help customers deal with this major regulatory and digital change. Joint interview.

Cyrille Sautereau: “We need to start preparing now for the massive dematerialization of invoices scheduled for 2023. It has already been compulsory since 2020 for all invoices for the public sector to be presented in electronic format. After an interim tolerance period, the obligation becomes fully effective in 2021 and Chorus Pro becomes the obligatory method for exchanging invoices with the public sector. However, what is called B2G (Business to Government) only represents 5% of invoice flows in France. In this regard, the generalization of electronic invoicing in B2B will represent a huge step forward.”

Christophe VIRY: “The deadline of January 1, 2023 seems very close to me. To be operational by this date, pilot phases will be needed from the second half of 2022, preceded by development and analysis phases in 2021 and 2022. Before all this, the consultation groups organized by the French tax authorities (DGFiP) will also need to be held, and are scheduled for the whole of 2021. In my opinion, it’s vital to tackle compliance with the reorganization well in advance, because there will be a significant overload of activity in 2022 in a market where the expertise available is already in limited supply.”

Cyrille Sautereau: “It will be organized on the same roll-out model as Chorus Pro. The dematerialization of the issuing of B2B invoices will be gradual, with an obligation to issue by electronic means on January 1, 2023 for large companies, then on January 1, 2024 for mid-sized companies and finally for all companies on January 1, 2025. However, all businesses will be required to be able to receive electronic invoices as of January 1, 2023. Thus, any company will need to be able to process them on receipt, and also to send back to the tax authorities (and to the supplier) not only a minimum response concerning future payment, but also probably some form of intermediate processing documents such as an acknowledgment of receipt or a notification of approval or rejection, etc.“

Christophe VIRY: “The calendar presents quite a challenge. The same principles as the Chorus Pro program will be applied, but over 3 years instead of 4. We know there will be 3 times more businesses to handle on-line and 20 times more volume to process. This is why the so-called Y architecture, based on the operators already in place, is so important. It will facilitate roll-out and prolong procedures that are already in place.”

Cyrille Sautereau: “The provisions that will apply from 2023 have been confirmed in detail for the period 2023 to 2025. All businesses will need to issue and receive electronic invoices which will need to be transmitted in real time to the tax authorities in the form of either the invoice itself or of precise notification of the data contained in the invoice. The specific objective is to fight against VAT fraud. The report ‘VAT in the digital age in France’ was published in November 2020 and describes the main procedures envisaged. Article 95 of the 2021 Finance Law specifies the implementation schedule and adds an obligation of e-reporting, in particular for sales flows outside the scope of the basic procedures (such as B2C, exports, and deliveries to EU member states). The mandatory nature of the electronic invoice is thus confirmed, as are the terms of application for the period 2023/2025. The DGFiP report and the Article 195 text introduced a concept of compulsory additional e-reporting. This opens the way to a prior pre-declaration of VAT and to VAT declarations that are made as required, practically in real time.”

Christophe VIRY: “Over and above what is described in the report ‘VAT in the digital age in France’, the details of the procedures will be clarified shortly after the conclusion of the working groups initiated by the DGFiP with professionals, including the GENERIX Group. Numerous subjects are covered: the format of the invoices, the nature of the invoices, e-reporting, the directory, the certification of operators, data recording, monitoring, and support and communication for companies.”

Cyrille Sautereau: “The technical formats of the electronic invoices have not yet been fully defined, but they should be formalized by the tax administration by the first few months of 2021. The electronic invoice must be readable to human eyes, probably in the form of a PDF document with all the current mandatory information. What is important to specify is that this document must be supplemented by a series of structured data which will allow consistency checks and, ultimately, the complete automation of processing. A simple PDF will therefore no longer be sufficient to cope with these constraints: companies will need to implement invoice formats containing at least a full set of mandatory data required in structured form, completed or accompanied by a readable version in the form of a PDF, for example. This is particularly the case with the format Factur-X developed by the National Electronic Invoice Forum (FNFE-MPE) and by its German counterpart (FeRD), itself compliant for structured data with European Standard EN16931 published by CEN (the European Standardization Committee).”

Christophe VIRY: “I agree with Cyrille: for all sizes of companies, the combined obligations of receiving electronic invoices, moving towards structured electronic data and ensuring readability can only be covered by mixed invoice models such as Factur-X.”

Cyrille Sautereau: “Companies that still edit invoices in PDF format will at a minimum have to implement solutions that will associate the data required by the tax authorities with their PDF documents. This data will also be used by their customers to automate the processing of invoices. This new approach will become a requirement for companies’ operating methods: in particular in terms of invoice flow management, new technical constraints will need to be integrated.”

Christophe VIRY: “Yes, companies will have to turn to solutions supporting this new data and to certified electronic invoice operators who can certify their invoices. Service providers already offer multiple ways of creating structured electronic invoices: for example, starting from a PDF, an input form, a PO Flip, a virtual printer, etc. Many services will be proposed to mitigate the impact on companies’ internal business systems. As another example, the EURINV program of the European Commission has funded converters between syntaxes including EANCOM to the syntaxes corresponding to the EN 16931 standard. This allows the user not to need to change their billing format.”

Cyrille Sautereau: “The State will set up a national platform which will be, in a way, an extension of Chorus Pro to manage these B2B flows. The 2021 Finance Law indicates that service providers can be certified to process these invoices on behalf of their customers. They will themselves carry out the checks required by law and provide the required data to the national platform, which will transmit them to the tax administration in real time. Thus, the national platform and all the certified service providers will be able to exchange their invoices and transmit the mandatory elements to the tax administration, which will improve the interoperability of all stakeholders. To interface with the national platform, SMEs will be able to turn to software publishers, sometimes to their accountants and to the many other players who will position themselves in this new market.”

Christophe VIRY: “The DGFiP has adopted the same architectural model as Mexico and intends to rely on a network of certified platforms. We are keen to find out the conditions of this authorization process and to become one of the first operators to act as a trusted third party on behalf of the tax administration. The GENERIX Group already has this profile in various countries such as Italy, Spain and Portugal.”

Cyrille Sautereau: “Although the electronic invoice can be seen as a constraint, in addition to the possibilities of automation for large accounts and for the public sector, it will also present undeniable advantages for SMEs. The electronic invoice should enable them to benefit from better payment terms and the automated detection of late payments. I believe that some small businesses will have a vested interest in issuing electronic invoices ahead of the legal timetable simply because all businesses will be required to accept them as of January 1, 2023. They will then be able to benefit from its advantages as soon as possible, in particular through having a definite transmission date and through bylaws which will become mandatory, including that relating to the payment date. Speeding up payments is an important political issue, as many SMEs cease trading not from lack of orders, but from lack of liquidity due to excessively long payment terms. This project is in line with the European strategy for the digital transformation of the economy and improving the resilience of companies through the climate and digital transitions. It aims to push European companies to adopt more efficient, more automated operating methods and to accelerate flows between companies. The objective is to reduce companies’ working capital requirement (WCR) in order to allocate financial resources to innovation rather than to payment deadlines.”

Christophe VIRY: “The electronic invoice provides multiple and proven gains. This is why many companies have deployed it rather than issuing bonds and consider that its use gives them a competitive advantage. This advantage will disappear with its generalization. Also, companies have an interest in innovating and investing in the new opportunities offered by this reform. It makes possible a complete digitalization of invoicing processes and will initiate the development of new services, for example in the domain of payments or financing. It is in this direction that the GENERIX Group has been orienting its R&D investments for the last several quarters.”

To optimize inventory management, retailers and suppliers are increasingly turning to Vendor Managed Inventory (VMI) tools that transfer the responsibility…

In an ever-evolving logistics environment, agile and precise warehouse resource management is essential to remain competitive. With increasing volumes driven…

France’s electronic invoicing reform relies on a Y-architecture, where Partner Dematerialization Providers (PDPs) play a central role in issuing and…

Work with our team to build your ideal supply chain software stack and tailor it to your unique business needs.